Blog

Blog

Back to Blog

The Unicorn Club: Billion Dollar Startups

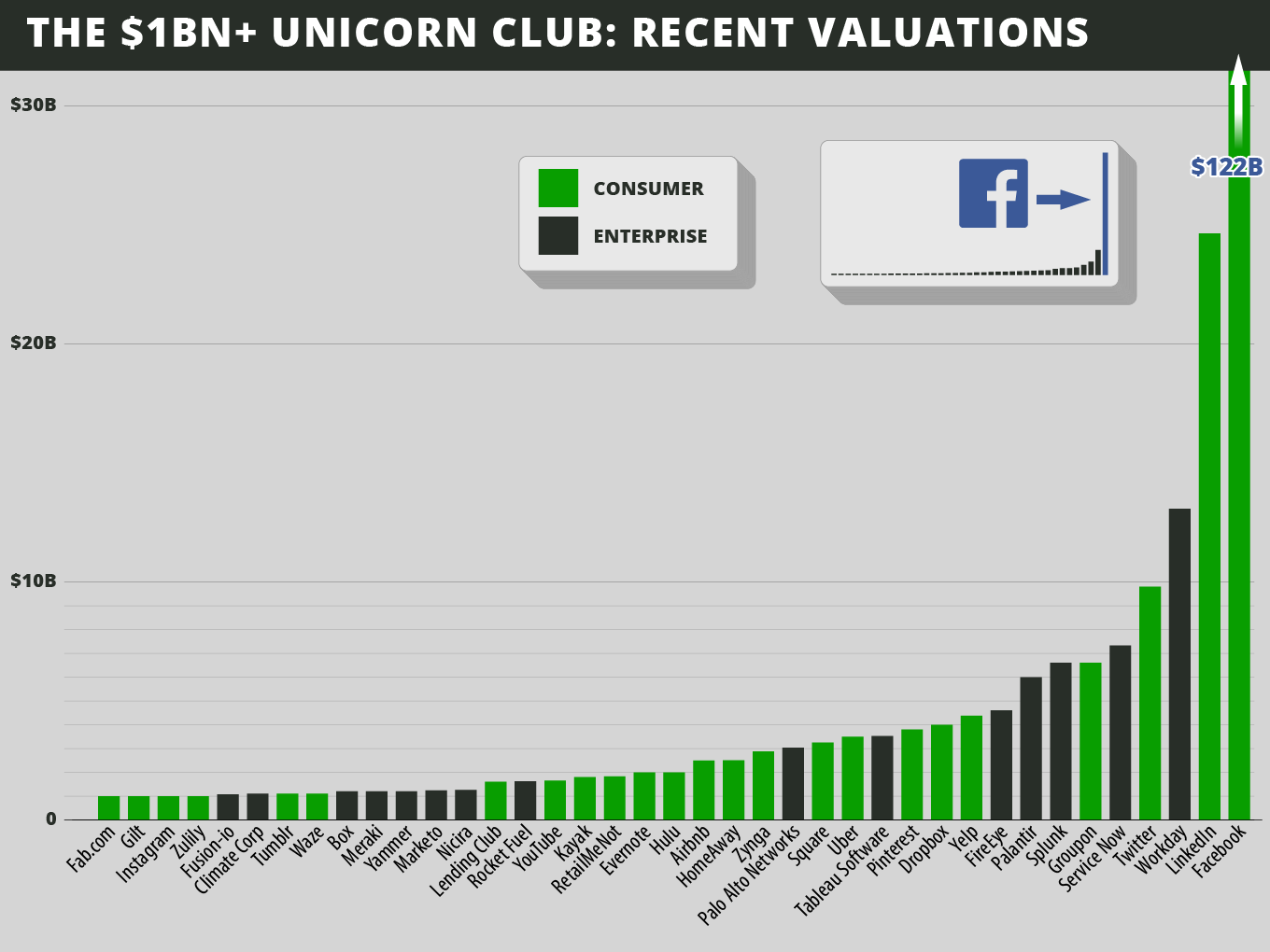

- We found 39 companies belong to what we call the “Unicorn Club” (by our definition, U.S.-based software companies started since 2003 and valued at over $1 billion by public or private market investors). That’s about .07 percent of venture-backed consumer and enterprise software startups.

- On average, four unicorns were born per year in the past decade, with Facebook being the breakout “super-unicorn” (worth >$100 billion). In each recent decade, 1-3 super unicorns have been born.

- Consumer-oriented unicorns have been more plentiful and created more value in aggregate, even excluding Facebook.

- But enterprise-oriented unicorns have become worth more on average, and raised much less private capital, delivering a higher return on private investment.

- Companies fall somewhat evenly into four major business models: consumer e-commerce, consumer audience, software-as-a-service, and enterprise software.

- It has taken seven-plus years on average before a “liquidity event” for companies, not including the third of our list that is still private. It’s a long journey beyond vesting periods.

- Inexperienced, twentysomething founders were an outlier. Companies with well-educated, thirtysomething co-founders who have history together have built the most successes

- The “big pivot” after starting with a different initial product is an outlier.

- San Francisco (not the Valley) now reigns as the home of unicorns.

- There is very little diversity among founders in the Unicorn Club (no female founders at all!).

(source)